Data Analysis on a Loan Application Dataset using Python

An Exploratory Data Analysis and a Linear Regression model on Loan Applications at a Bank.

1. Introduction

The source of the dataset is from a companion page for Woolridge J. (2013). Introductory Econometrics: A Modern Approach.

The dataset contains data on loan applications to a bank, including various types of information on the applicant and the purpose of the loan, along with the eventual loan decision (approve or reject - see the column loan_decision).

You can find the Github repo for this project here.

2. Load the Dataset

1

2

3

4

5

6

7

#import the required libraries for data analysis in Python

import numpy as np #for efficient numerical operations

import pandas as pd #for manipulating and visualising data

from scipy import stats #for statistics

#read the csv file containing the details of the loan applicants

df = pd.read_csv("loanapp.csv")

1

2

#count and print the number of enteries in the dataset

print("The total number of enteries in the dataset is", len(df))

The total number of enteries in the dataset is 1988

3. Descriptive Statistics on the Dataset

1

2

#descriptive statistics on the dataset

df.describe()

| occupancy | loan_amount | applicant_income | num_units | num_dependants | monthly_income | purchase_price | liquid_assets | mortage_payment_history | consumer_credit_history | property_type | |

|---|---|---|---|---|---|---|---|---|---|---|---|

| count | 1988.000000 | 1988.000000 | 1988.000000 | 1984.000000 | 1985.000000 | 1988.000000 | 1988.000000 | 1988.000000 | 1988.000000 | 1988.000000 | 1988.000000 |

| mean | 1.031690 | 143.272636 | 84.684105 | 1.122480 | 0.771285 | 5195.220825 | 196.304088 | 4620.333873 | 1.708249 | 2.110161 | 1.861167 |

| std | 0.191678 | 80.531470 | 87.079777 | 0.437315 | 1.104464 | 5270.360946 | 128.136030 | 67142.936043 | 0.555335 | 1.663256 | 0.535448 |

| min | 1.000000 | 2.000000 | 0.000000 | 1.000000 | 0.000000 | 0.000000 | 25.000000 | 0.000000 | 1.000000 | 1.000000 | 1.000000 |

| 25% | 1.000000 | 100.000000 | 48.000000 | 1.000000 | 0.000000 | 2875.750000 | 129.000000 | 20.000000 | 1.000000 | 1.000000 | 2.000000 |

| 50% | 1.000000 | 126.000000 | 64.000000 | 1.000000 | 0.000000 | 3812.500000 | 163.000000 | 38.000000 | 2.000000 | 1.000000 | 2.000000 |

| 75% | 1.000000 | 165.000000 | 88.000000 | 1.000000 | 1.000000 | 5594.500000 | 225.000000 | 83.000000 | 2.000000 | 2.000000 | 2.000000 |

| max | 3.000000 | 980.000000 | 972.000000 | 4.000000 | 8.000000 | 81000.000000 | 1535.000000 | 1000000.000000 | 4.000000 | 6.000000 | 3.000000 |

The table above describes the descriptive statistics on the numerical variables of the dataset, namely, number of values(count), mean, standard deviation, minimum and maximum values in the columns.

4. Checking for Missing Data

By analyzing the count values from step 3, it can be identified that there are some missing values in the columns. Hence, the dataset needs to be checked for all missing values and is cleaned for better and accurate analysis. This is an important step that needs to be carried out before conducting any Exploratory Data Analysis.

1

2

3

#check if the dataset contains null values

#the function below counts the number of missing values in each column

df.isnull().sum()

1

2

3

4

5

6

7

8

9

10

11

12

13

14

15

16

17

18

married 3

race 0

loan_decision 0

occupancy 0

loan_amount 0

applicant_income 0

num_units 4

num_dependants 3

self_employed 0

monthly_income 0

purchase_price 0

liquid_assets 0

mortage_payment_history 0

consumer_credit_history 0

filed_bankruptcy 0

property_type 0

gender 14

dtype: int64

In the 1988 entries, the number of missing values in each column is displayed above. Following on, the entries with missing values are deleted from the dataset to carry out clean and accurate data analysis.

1

2

#to delete all the missing values

df.dropna(inplace=True, axis="rows")

1

2

#to check if there are still any missing values in the dataset

df.isnull().sum()

1

2

3

4

5

6

7

8

9

10

11

12

13

14

15

16

17

18

married 0

race 0

loan_decision 0

occupancy 0

loan_amount 0

applicant_income 0

num_units 0

num_dependants 0

self_employed 0

monthly_income 0

purchase_price 0

liquid_assets 0

mortage_payment_history 0

consumer_credit_history 0

filed_bankruptcy 0

property_type 0

gender 0

dtype: int64

As seen above, there are no more missing values in the dataset.

1

2

#new number of enteries in the dataset

print("No. of enteries in the dataset after deleting the missing values are", len(df))

1

No. of enteries in the dataset after deleting the missing values are 1969

5. Displaying the distribution of (some of) numerical variables as histograms.

1

2

3

4

5

6

7

8

#the range of loan amounts is displayed as an histogram

loanamt = df["loan_amount"].hist(bins=50)

#title of the histogram

loanamt.set_title("Range of Loan Amounts")

#x-axis title

loanamt.set_xlabel("Loan Amount in thousands")

#y-axis title

loanamt.set_ylabel("No. of Applicants")

Text(0, 0.5, ‘No. of Applicants’)

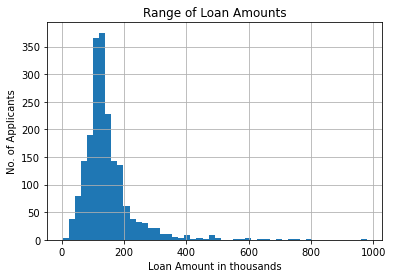

The above graph describes the range of loan amounts that are applied by the applicants.

It is seen that majority of the applicants have applied for a loan amount between £150-200,000.

1

2

3

4

5

6

7

8

#the range of applicants incomes are2 displayed as an histogram

appinm = df["applicant_income"].hist(bins=50)

#title of the histogram

appinm.set_title("Range of Applicants Incomes")

#x-axis title

appinm.set_xlabel("Applicant Income in thousands")

#y-axis title

appinm.set_ylabel("No. of Applicants")

Text(0, 0.5, ‘No. of Applicants’)

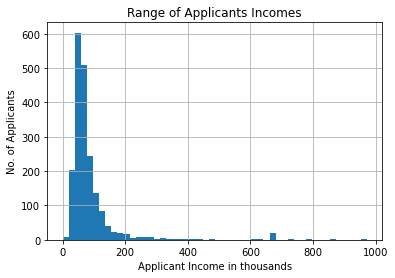

The above graph describes the range of income the applicants earn as an histogram.

The vast majority of the applicants have an income between £20-100,000.

6. Displaying unique values of a categorical variable.

1

2

#to display unique values of the categorical variable - race

print("The different races that are in the dataset are", df.race.unique())

The different races that are in the dataset are [‘white’ ‘black’ ‘hispan’]

7. Statistical Test

Building a contingency table of two potentially related categorical variables and conducting a statistical test of the independence between the variables.

1

2

3

4

#contingency table is created between race and their loan decisions

ct = pd.crosstab(df["race"], df["loan_decision"])

#display the contingency table

ct

| race | approve | reject |

|---|---|---|

| black | 131 | 64 |

| hispan | 82 | 26 |

| white | 1514 | 152 |

1

2

3

4

5

6

7

8

#the contingency table is plotted in a bar graph for visual understanding

ct.plot(kind="bar", stacked=True, rot=0)

#the chi-square test is conducted to check the independence between the variables

chi2, p_val, dof, expected = stats.chi2_contingency(ct)

#print the p-value

print(f"p-value: {p_val}")

p-value: 1.1422552252120337e-23

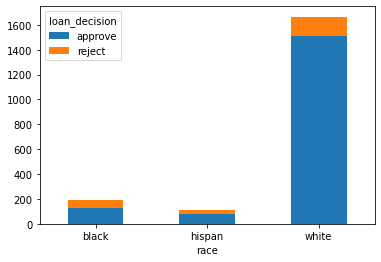

The bar graph shows the distribution of number of loans accepted and rejected as per the applicant’s race.

For the chi-square test,

Null Hypothesis - There is no dependence between race and loan decision.

Alternate Hypothesis - There is dependence between race and loan decision.

Since, the p-value is less than the significane level (0.05), the null hypothesis is rejected. i.e., evidence of strong dependence between race and loan decisions is found.

8. Subset the Dataset and Descriptive Statistics

Retrieving a subset of the data based on two or more criteria and presenting descriptive statistics on the subset.

1

2

3

4

5

6

7

#subset for applicant income for accept and reject.

#loan amount

#find their means

#find their sum

subset = df[["loan_amount", "applicant_income"]]

subset

| loan_amount | applicant_income | |

|---|---|---|

| 0 | 128 | 74 |

| 1 | 128 | 84 |

| 2 | 66 | 36 |

| 3 | 120 | 59 |

| 4 | 111 | 63 |

| … | … | … |

| 1983 | 158 | 96 |

| 1984 | 35 | 169 |

| 1985 | 225 | 49 |

| 1986 | 98 | 110 |

| 1987 | 133 | 55 |

1969 rows × 2 columns

1

2

#display descriptive statistics of the subset

subset.describe()

| loan_amount | applicant_income | |

|---|---|---|

| count | 1969.000000 | 1969.000000 |

| mean | 143.505333 | 84.908075 |

| std | 80.802291 | 87.439115 |

| min | 2.000000 | 0.000000 |

| 25% | 100.000000 | 48.000000 |

| 50% | 126.000000 | 64.000000 |

| 75% | 165.000000 | 88.000000 |

| max | 980.000000 | 972.000000 |

The above table displays the descriptive statics on the applicants based on their loan amount applied for and the applicant’s income of the property that they have applied the loan for are displayed in thousands.

The average of loan amount and applicant income are £143,505 and £84,908£, respectively, with a standard deviation of 80,000, 87,439, respectively. Finally, it is seen that the maximum amount of loan applied for among the applicants is £980,000.

9. Statistical Test

Conducting a statistical test of the significance of the difference between the means of two subsets of the data.

1

2

3

#count the number of applications that are aprroved and rejected

print("The no. of applications approved and rejected are displayed below: ")

df["loan_decision"].value_counts()

1

2

3

4

5

The no. of applications approved and rejected are displayed below:

approve 1727

reject 242

Name: loan_decision, dtype: int64

1

2

3

4

#calculate the mean monthly income of applicants whose loan got approved

app = df[df["loan_decision"] == "approve"]["monthly_income"]

mean1 = app.mean()

print("The mean monthly income of applicants whose loan got approved", mean1)

1

The mean monthly income of applicants whose loan got approved 5256.380428488709

1

2

3

4

#calculate the mean monthly income of applicants whose loan got rejected

rej = df[df["loan_decision"] == "reject"]["monthly_income"]

mean2 = rej.mean()

print("The mean monthly income of applicants whose loan got rejected", mean2)

1

The mean monthly income of applicants whose loan got rejected 4837.01652892562

An independent two sample t-test is conducted to test the significance of difference between the means of monthly income of applicants whose applications got approved and rejected.

The formulated hypothesis is:

Null hypothesis: the difference between the mean is assumed to be zero

Alternate hypothesis: there is a significant difference between the two means

A significance level of 0.05 is chosen.

1

2

3

4

#conduct a independent two sample t-test

t_val, p_val = stats.ttest_ind(app, rej)

print(f"t-value: {t_val}, p-value: {p_val}")

1

t-value: 1.1548741531963007, p-value: 0.24828224204569163

The p_value from the t-test is greater than 0.05. Therefore, the null hypothesis is accepted which indicates that there is no difference between the mean monthly income of applicants whose applications got approved and rejected.

10. Pivot Tables

1

2

ptable = df.groupby("gender").sum()

ptable

| gender | occupancy | loan_amount | applicant_income | num_units | num_dependants | self_employed | monthly_income | purchase_price | liquid_assets | mortage_payment_history | consumer_credit_history | filed_bankruptcy | property_type |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| female | 376 | 44344 | 26041 | 421.0 | 142.0 | 32 | 1600963 | 60367.030 | 39029.414 | 652 | 799 | 25 | 621 |

| male | 1656 | 238218 | 141143 | 1790.0 | 1375.0 | 225 | 8647364 | 327030.897 | 9145154.576 | 2707 | 3356 | 110 | 3046 |

11. Linear Regression

Implementing a Linear Regression model and interpreting its output.

1

2

#import the required library for conducting linear regression

import statsmodels.api as sm

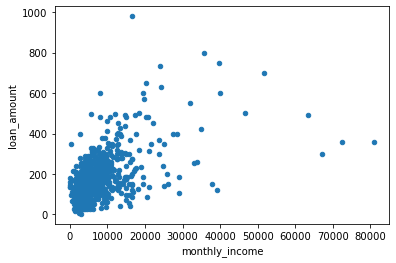

A linear regression model is implemented to predict how much loan amount is applied for based on the applicant’s income, monthly income and the purchase price of the property.

The dependent variable y is loan_amount

The independent variables are monthly_income, applicant_income and purchase price

1

2

#plot monthly income and loan amount to describe their relationship

df.plot.scatter(x="monthly_income", y="loan_amount")

1

2

#plot applicant income and loan amount to describe their relationship

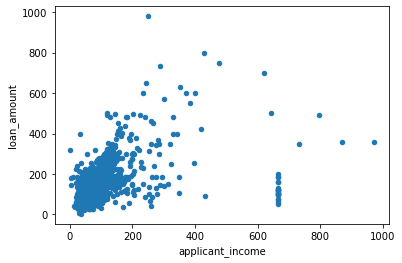

df.plot.scatter(x="applicant_income", y="loan_amount")

1

2

#plot purchase price and loan amount to describe their relationship

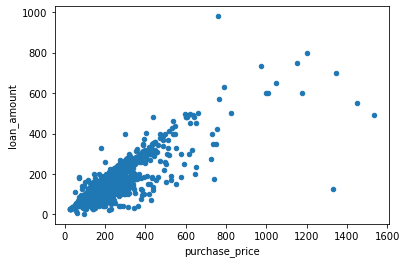

df.plot.scatter(x="purchase_price", y="loan_amount")

From the scatter plots above between monthly_income,purchase_price, applicant_income vs loan_amount, it can be seen that there is a positive linear relationship between the variables.

1

2

3

4

#run multiple linear regression

#the line of best fit in this linear regression model is found using the OLS model

model = sm.OLS.from_formula(

"loan_amount ~ monthly_income + applicant_income + purchase_price", data = df).fit()

1

2

#produce summary of the model

model.summary()

| Dep. Variable: | loan_amount | R-squared: | 0.702 |

| Model: | OLS | Adj. R-squared: | 0.702 |

| Method: | Least Squares | F-statistic: | 1546.0 |

| Date: | Thu, 01 Apr 2021 | Prob (F-statistic): | 0.00 |

| Time: | 09:44:40 | Log-Likelihood: | -10248.0 |

| No. Observations: | 1969 | AIC: | 2.050e+04 |

| Df Residuals: | 1965 | BIC: | 2.053e+04 |

| Df Model: | 3 | ||

| Covariance Type: | nonrobust |

| coef | std err | t | P> | t | [0.025 | 0.975] | ||

|---|---|---|---|---|---|---|---|---|

| Intercept | 39.0811 | 1.848 | 21.153 | 0.000 | 35.458 | 42.704 | ||

| monthly_income | 0.0010 | 0.000 | 3.664 | 0.000 | 0.000 | 0.001 | ||

| applicant_income | 0.0455 | 0.014 | 3.265 | 0.001 | 0.018 | 0.073 | ||

| purchase_price | 0.4855 | 0.010 | 48.455 | 0.000 | 0.466 | 0.505 |

| Omnibus: | 763.117 | Durbin-Watson: | 1.985 |

| Prob(Omnibus): | 0.000 | Jarque-Bera (JB): | 80164.594 |

| Skew: | -0.834 | Prob(JB): | 0.00 |

| Kurtosis: | 34.214 | Cond. No.: | 1.38e+04 |

Notes:

- Standard Errors assume that the covariance matrix of the errors is correctly specified.

- The condition number is large, 1.38e+04. This might indicate that there is strong multicollinearity or other numerical problems.

Coefficients on the variables. The estimated coefficients are specified in the second table. Our model is thus described by the line:

loanamount = 39.0811 + 0.0010monthlyincome + 0.0455applicantincome + 0.4855*purchaseprice +e.

Considering the signs on the coefficients we can state that the loan amount applied for is positively affected by all the independent variables (greater the value of the variables, greater the amount of loan applied for).

Significance of the variables. The p-values on all the coefficients indicate that the variables are significant, i.e., the factors do have a significant effect on the loan amount (p-values < 0.05).

Quality of the model. The $R^2$ and the adjusted $R^2$ values are at 0.702 which shows a great fit compared to all other models. Only the best model is shown in the output.

12. Checking the assumptions of normality and zero mean of residuals

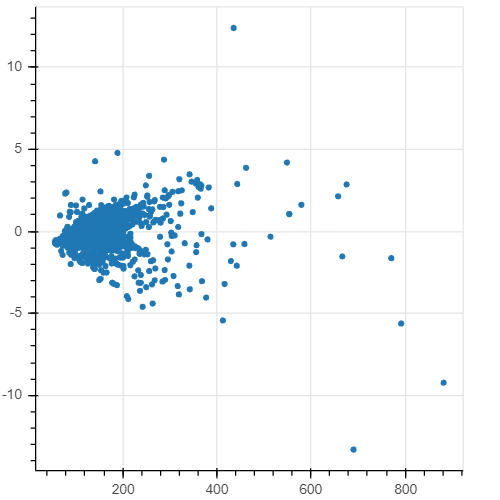

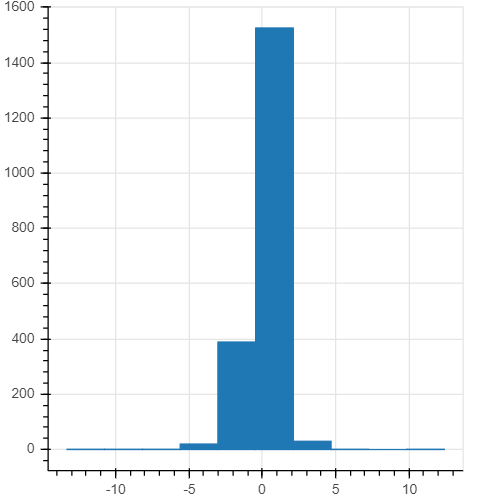

The standardized residuals and their histogram are plotted to confirm that the assumptions of normality of the distribution of residuals and of the zero mean of residuals are valid with this model.

1

2

3

4

5

6

#import bokehJS for plotting and showing figures

from bokeh.io import output_notebook

output_notebook()

from bokeh.plotting import figure

from bokeh.io import show

1

2

3

4

5

6

7

8

fig = figure(height=400, width=400)

# the x axis is the fitted values

# the y axis is the standardized residuals

st_resids = model.get_influence().resid_studentized_internal

fig.circle(model.fittedvalues, st_resids)

show(fig)

1

2

3

4

5

# create a histogram with 10 bins

hist, edges = np.histogram(st_resids, bins=10)

fig = figure(height=400, width=400)

fig.quad(top=hist, bottom=0, left=edges[:-1], right=edges[1:])

show(fig)

The scatterplot and the histogram suggests that the residuals are equally distributed around 0 and are normally distributed. The results of the Jarque-Bera test on the residuals (the third table of the summary) also indicate that the errors are distributed normally: the p-value equals 0.00, therefore we cannot reject the null hypothesis of normal distribution.

Therefore, the provided linear regression model holds and is valid to make predictions on the amount of loan that will be applied by the applicant based on the applicants income, monthly income and the purchase price.